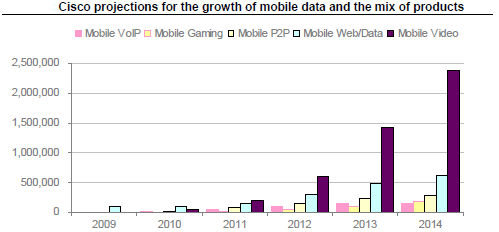

Data traffic the world over has increased at a dramatic pace in the last 3 years, and is set to maintain its momentum for the next five years, as per studies by Cisco.

In India too, this is likely to happen, and through a variety of applications, which may or may not have easily monetizable business

models. We are less concerned about the specifics of any application. What concerns us more is that over time, data traffic will grow rapidly in India, and the greater data-friendly spectrum holding of RIL, who has won BWA spectrum on a pan-India basis and some other telcos will expose the limitation of the spectrum held by GSM incumbents.

We feel that the Home, SME and handset based broadband will be the three segments that the wireless broadband market will develop

into. Incumbent GSM operators will be at an advantage in the handset segment, as they have 3G spectrum and a high-ARPU subscriber base relative to CDMA players. However they will be at a disadvantage in the Home and SME broadband market, as competition has better spectrum assets, and will aggressively market services.