We have already shown you the 3G Spectrum Maps of Bharti Airtel and Idea Cellular here.

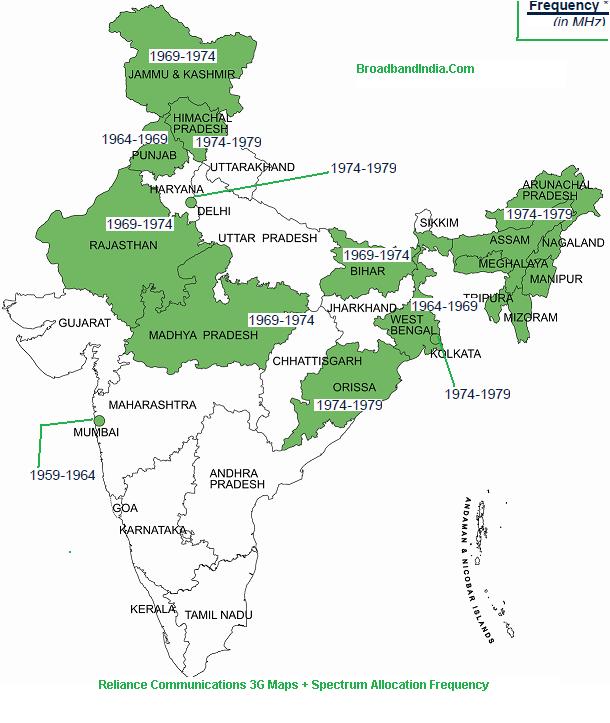

Reliance Communications put up an aggressive showing in the 3G auctions, where it has a payout obligation of over US$1.8bn in addition to the US$4.3bn debt currently. This would lead to a debt-to-EBITDA of over 3.5x. In addition to this, there will be an outlay of US$1bn-US$1.5bn for rolling out 3G services (over the next three years) implying that RCOM may dilute equity to fund the payout. The tower business looks to be the likely source of dilution. Here is the 3G Spectrum Map of Reliance Communications available for Coverage along with allocated Spectrum superimposed on Shaded areas of the map .

.

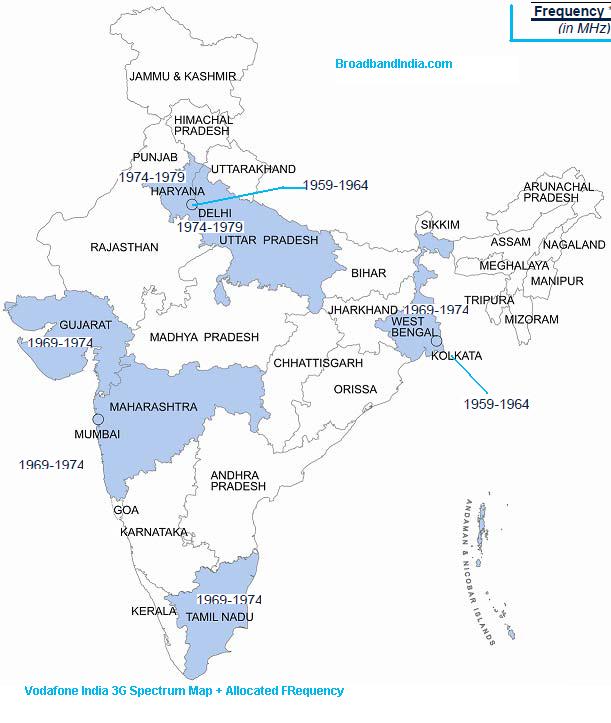

Vodafone India seemed to have followed a ‘defensive’ strategy like Bharti, by acquiring spectrum in key markets, while foregoing a few big circles where it does not enjoy leadership or has substantial difference to the leader (like Karnataka and Rajasthan). Here is the 3G Spectrum Map of Vodafone in India along with frequency allocation.

You can also see the complete 2G Spectrum Allocation frequencies for CDMA and GSM operators across all India.

1 thought on “Reliance Communications + Vodafone 3G Spectrum Maps”

Comments are closed.